We have prepared a concise Quant report to assist you in navigating through Bitcoin and Crypto markets.

This report includes some essential data stats like spot and margin CVD charts, NPOC levels, Exchange Flows, Funding rates, and liquidation levels.

It is designed to assist all traders in predicting upcoming market movements based on fundamental data. By combining the analysis of CVD data with liquidity, we can confidently anticipate the next price movement. Our approach in this report is geared towards the medium term, providing the opportunity to forecast price movements for the next 2 to 4 days.

Towards the end of each data set, we have provided observations on the approach to the market. we hope this provides you with valuable insights as you read through.

Lets delve into this:

Tips : if you read daily , you will find an extraordinary edge on reading market state.

BTC CVD Charts

15m

Spot CVD: Bullish

Margin CVD: Neutral

Spot traders are buying BTC confidently , while Margin traders are flat with their position not showing any aggressive to any side .

1Hr

Spot CVD: Bullish

Margin CVD : Neutral Bullish

Since price made dump , Spot BTC price developing strongly and efficiently because of Spot traders buying.

4Hr

Spot CVD: Bullish

Margin CVD: Neutral

Daily

Spot CVD: Bullish

Margin CVD: Neutral

Observation :

As we discussed , Spot consistently leading post-dump move , price development suggests growth in BTC price is totally leading by Spot traders , which is generally healthy sign for the price growth. It still intact till now.

Note : Cumulative Volume Delta (CVD) displays the cumulative volume changes based on the volume traded by sell aggressors versus buy aggressors

Bullish divergence indicates a potential reversal to the upside ,

While Bearish divergence suggests weakening upward momentum.

NPOC Levels (BTC)

NPOC (Naked Point Of Control) aids in identifying key areas with significant remaining liquidity, enabling us to see where whales left most unrealised orders. NPOC levels consistently act as price magnets, with the price closing them in over 85% of cases. These levels often signal reversals, but can also indicate continuation. Primarily, they serve as valuable tools for placing limit buy and sell orders, as well as predicting the likely direction of the price in the subsequent move.

Daily

Above : No New nPOC open Upside , All Time High Above

Below : 68000 , 57000

4hr*

Above : - -

Below : 68000 , 66000

ETH Daily nPOC chart

Above :

Below : 3800 (New Open)

Funding rate:

OI Weighted Funding: 0.0577%

With breach of STH 69k , Funding again jumped to heatzone.

Note : Funding represents periodic payments between Long and Short position participants in a perpetual futures contract. A deviation from neutrality suggests an imbalance in market positioning by one side of traders which must needs to rebalance.

Positive funding means positions are dominated by Long side participants , Negative funding means positions are dominated by Short side participants.

Traders closely monitor funding rates for strategic decision-making.

Exchange balance: Inflows and Outflows from exchanges

18.8k Daily Inflow

Past 24hr , Huge Inflow of BTC observed . Means Amid price broke ATH , some wallets possibly selling their BTC here

Note: Positive net flows indicate more Bitcoin coming into the exchange than leaving, while negative net flows suggest more Bitcoin leaving the exchange than entering.

if our report helps you out to gauge the market state , Give a follow and appreciate our work!!

Subscribed

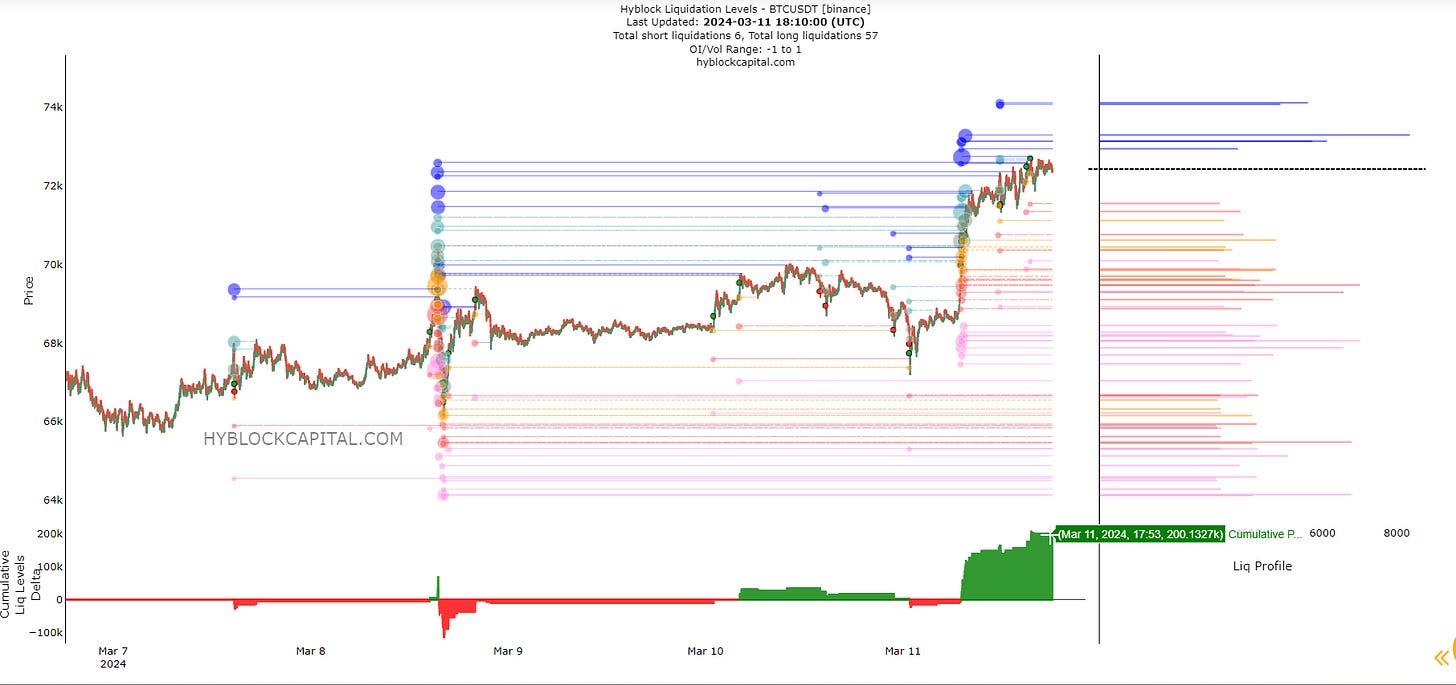

Aggregated Exchanges Liquidation Levels

24hr Liquidity Map Distribution : (LTF past 24hr liquidity ranges between)

Upside : 73000 - 74500

Downside: 72000 - 67000

As per discussed , Nearest liquidity taken out , so possible large move could be possible by BTC , which we now see . With this expansion , ltf lowerside liquidity are more than upside .

Note : This shows nearest liquidity residing around exchanges.

X-axis represents the mark price, while the Y-axis represents the relative intensity of liquidation.

Higher "liquidation bars" indicate a stronger reaction due to a surge in liquidity.

Liquidation Levels (Tier 0)

Total Liquidations: Short 90, Long 301

Active Long posi. size : $ k 531

(Tier 1)

Total Liquidations: Short 6,Long 57

Active Short posi. size : $ k 200

Long now dominated with 1:3 ratio with each position liquidation size of 530k

Liquidation Heatmap

Weekly:

Upside : 75k - 80k

Downside : 65k 60k

12 Hr

Upside : 73k - 75k

Downside : 71k - 70k

Note : Liquidation level & Heatmap predicts the price levels at which large-scale liquidation events may occur. A liquidation event occurs when a trader's positions are closed due to price fluctuations and their margin account balance is insufficient to cover the open positions

Traders who can estimate the liquidation levels of other traders may gain an advantage similar to understanding high liquidity in the order book.

Conclusive Insight:

First of all just to make it easy for you, we will request you must not miss reading any of our report, data are closely interlinked with each other, continuity helps you to understand the overall shift in the price microstructure state .

BTC 4hr TF

In previous report , we were quite confident with observing Spot traders buying strength which possibly suggest strong buy sentiment , while Margin still flat , so basically no overpositioning from lev traders side . While with this breach expansion funding spiked up which is general , However BTC huge Inflows observed in past 24hr with 18.8K BTC flows into the exchange , possible for the sale.

Overall BTC is strong while ltf retracement , pullback will happen but HTF is just lead by buyers.

Follow us for receiving our valuable report on each alternate days, Advantage ? You keep able to gauge and sync with the state of the market . , If you are new to this , Must Request to read our previous report too : 9th Mar BTC Quant Report Newsletter

Subscribe to our newsletter and we'll deliver it straight to your email.

Until next time, Happy trading, and stay tuned for more updates.